Recently, there have been more stories about Yahoo shutting bits of its business than celebrating successes.

The firm’s own internet services are now valued to be worth a fraction of its stake in the e-commerce giant Alibaba.

So, after the US tax authorities effectively blocked Yahoo’s sales of shares in the Chinese business, chief executive Marissa Mayer opted for plan B: sell off Yahoo’s core business.

Since February, dozens of US-based companies have been linked to a potential bid.

But the UK-based owner of the Daily Mail newspaper has now confirmed it is in discussions with unnamed parties to make an offer – an announcement that caught many by surprise.

Does anyone use Yahoo anymore?

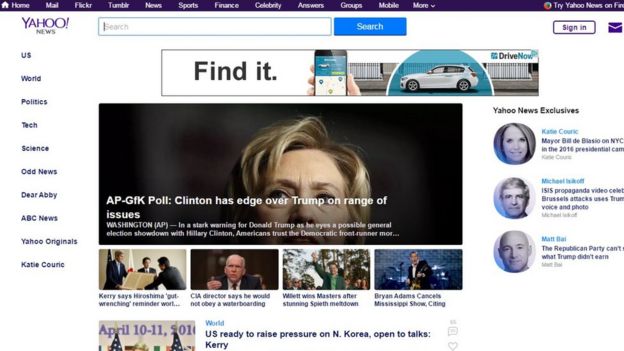

Image copyrightYahoo

Image copyrightYahooIn much of the world, Yahoo may be considered a marginal internet brand.

But in the US, it is still a force to be reckoned with.

In February, it was the States’ third most visited online platform, attracting more than 204 million people, according to research firm Comscore.

To put that in context, Facebook had only 1% more users and Google’s apps and websites only 17% more.

Yahoo’s news and sports are read by about one in four people at least once a week in the country, according to a University of Oxford study.

And there are reports that its personal finance coverage is proving popular with millennials – those born in the 1980s and later – thanks to it mixing articles about how to deal with debt with more traditional earnings coverage.

Other properties, including its blogging platform Tumblr, photo-sharing service Flickr, web-based email accounts and Q&A site Yahoo Answers continue to have international appeal.

All of which means the firm can state that “more than one billion people” regularly use its products.

So, why not continue as it is?

Image copyrightGetty Images

Image copyrightGetty ImagesInvestors are getting restless because Yahoo’s share of users doesn’t match its share of online advertising sales.

Last year, Yahoo accounted for only 1.5% of marketers’ online spend, according to a study by eMarketer.

By contrast, Google scooped up 35% and Facebook 19%.

Furthermore, Yahoo’s position appears to be getting worse.

The firm has predicted that its overall revenues will drop by about 15% this year, according to documents seen by the news site Recode.

Why isn’t it doing better?

Image copyrightGetty Images

Image copyrightGetty ImagesA large part of the problem is that while Yahoo can serve up huge numbers of ads, they are less targeted than those of its rivals.

“User data is key. Google and Facebook have a huge number of logged-in users, so they can track who it is using their services and use the information to let advertisers direct their ads,” explained Joseph Evans from Enders Analysis.

“Yahoo might have a lot of users, but most of them are not logged into its services, so are effectively anonymous eyeballs.

“They are not totally anonymous – there is some behavioural data that Yahoo makes use of – but generally Google and Facebook are better at knowing who you are.”

In that case, what would be its appeal to the Daily Mail?

Image copyrightDaily Mail

Image copyrightDaily MailA chance to grow its US audience.

MailOnline and DailyMail.com were the only overseas publications to feature in the country’s top 10 most visited news websites and apps last year, attracting more than 51 million readers.

But Yahoo – and its partner ABC News – still managed to attract more than double that figure.

“The US has been the main driver of digital growth for Daily Mail & General Trust, but whilst traffic has grown well they haven’t quite monetised this traffic as successfully as they would have liked,” said Ian Whittaker, a media analyst at the investment bank Liberum.

“The combined inventory of DMGT and Yahoo would make a compelling offer to media buyers as they could offer them a significant amount of verified impressions in a ‘brand-safe’ environment.”

Another industry watcher added that the two firms’ online activities appear to be a good match.

“Mail Online is fun and a bit salacious,” commented Mathew Horsman from the Mediatique consultancy.

“It trends reasonably young and has a reputation for being a quick and dirty way of getting celebrity news, but its personal finance and property coverage are also among its strong suits.

“So, there are some interesting overlaps.”

So, is this a done deal?

Image copyrightGetty Images

Image copyrightGetty ImagesFar from it.

Many think a deal with Verizon would make more sense.

The mobile network has sought to diversify its interests, and bought AOL last year – which gave it ownership of the Huffington Post, Techcrunch, Engadget and other news sites.

Shortly afterwards, Verizon announced it would start combining personal knows about its mobile network subscribers – which is tied to their handsets – with the tracking data already gathered by AOL’s sites. By doing so it said it could deliver more “personalised” ads.

“A Verizon-AOL-Yahoo tie-up would start to reach the sort of scale where they could become a ‘third force’ in advertising,” said Mr Evans.

“Verizon already has one of the most sophisticated ad technology platforms and has built up a large number of user identities, so combining that with Yahoo’s large number of users would allow it to offer a similar level of service to advertisers as Google and Facebook.”

Other bidders might be attracted by Yahoo’s intellectual property,

The New York Post recently reported that the firm owned about 6,000 patents, which it said could be worth $4bn (£2.8bn).

Recode added that Ms Mayer has been talking up the value of Index – a voice-controlled search tool developed by Yahoo that has yet to be launched.

Google, Microsoft, Apple and Amazon already have virtual assistants of their own, but might be interested in acquiring Index if it genuinely offers innovative tricks of its own.

[Source:- BBC]