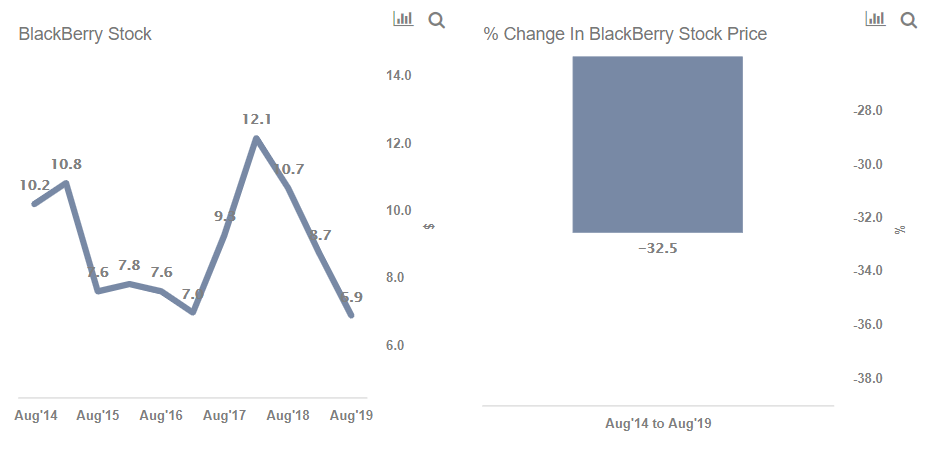

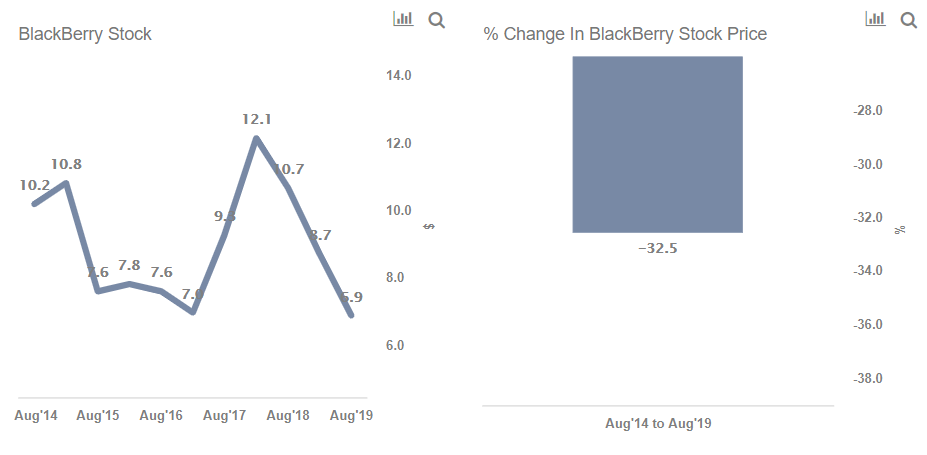

1. We break down the change in BB’s stock into 3 factors:

BB’s Stock Price = (Revenue / No. of Shares) x P/S Multiple

- The decline in BlackBerry’s stock price is being primarily driven by a sizable drop in its revenue, following the decline of its handset operations.

- However, the impact of the sharp revenue decline has been partially offset by BlackBerry’s pivot to the higher-margin software businesses, which has helped its P/S multiple.

2. BlackBerry’s Revenue has declined by over 85% from $6.8 billion in FY’14 to $900 million in FY’19

- BlackBerry’s revenue base has declined from about $6.8 billion in FY’14 to about $900 million in FY’19 (Fiscal years end February)

- The decline has come as BlackBerry exited the Handset business, amid mounting competition and the related decline in its lucrative Subscriber Access Fee (SAF) business, which charged access fees for BlackBerry’s Internet services. Both businesses no longer play a meaningful role in BlackBerry’s financials.

- While BlackBerry has scaled up its Software business almost 3.5x since FY’14, the business still remains small relative to the size of BlackBerry’s hardware and SAF business in its heyday. (Software revenues of $845 million in FY’19, versus Handset+SAF sales of $6.6 billion in FY’14.

2.1 Within The Software Business, Enterprise Software Growth Is Slowing Down

- Within the software operations, the Enterprise Software business is slowing, with reported revenue expanding just 3% over the last 2 years, although this was partly due to an accounting change.

- The company is increasingly emphasizing its Technology Solutions business, which caters to several fledgling or highly competitive areas such as autonomous driving systems, fleet tracking, and the Internet of Things. The long-term pay-offs may be uncertain here.

3. BlackBerry’s P/S Multiple has expanded from 0.8x in FY’14 to over 5x in FY’19, due to pivot toward the higher-margin Software business

- BlackBerry’s P/S multiple has expanded from about 0.8x in FY’14 to 5.2x in FY’19.

- The expansion can be explained partly by the pivot toward software-related businesses, which have higher margins and are seeing stronger growth.

3.1 Adjusted Net Margins Are Trending Higher

- Adjusted Net margins have moved from negative levels in FY’14 to levels of around 14% in FY’19, driven by significant cost cuts and higher sales of software.

- Software and services related sales account for more than 95% of revenues currently, up from 45% in FY’14

3.2 BlackBerry’s P/S Is Roughly In Line With Microsoft’s, And Well Ahead Of Rival Mobile Iron

- The expansion in P/S following the software pivot has made BlackBerry’s multiple roughly comparable to Microsoft’s, and well above rival Mobile Iron, which sells mobile device management software.

- However, the multiple declined slightly in FY’19.

4. Conclusion

While BlackBerry has turned around its operations, posting a small adjusted net profit over the last 3 years, the stock has underperformed given the precipitous decline in revenues, with the company remaining a shadow of its former self.

[“source=trefis”]