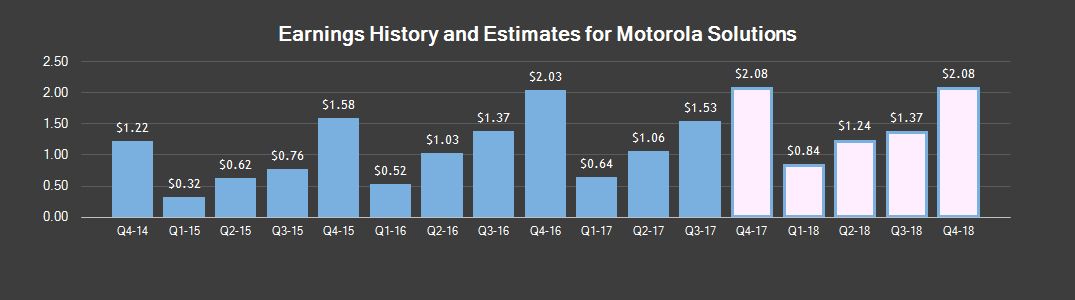

As Motorola Solutions’ core land mobile radio business has been seeing slowing growth over the last few years, the company has been banking on its services business to drive growth. The services business essentially provides end-to-end solutions ranging from implementation, optimization, and integration of networks, devices, software under the Integration Services unit, as well as repairs, technical support, and hardware maintenance under the Managed & Support services business. Below, we take a look at how the services business is performing and why it could be increasingly important to Motorola Solutions.

We remain neutral on Motorola Solutions, with a price estimate of about $89 per share.

Over the first nine-months of 2017, Motorola Solutions’ services revenues rose by about 9% year-over-year to $1.88 billion, compared to product sales which grew by less than 5%, and services now account for about 43% of the company’s revenues. The company’s services backlog remains strong, coming in at $7.1 billion at the end of Q3’17, up 6% from last year. While the growth has been driven partly by new contract wins, Motorola has also been making several acquisitions in the Managed & Support services space. In 2016 the company acquired Airwave – a British communications company which operates the network for the country’s emergency services. Motorola also announced a deal to acquire Kodiak Networks, which offers broadband push-to-talk technology to commercial customers. The company also completed its purchase of Interexport, a Chile-based managed services provider.

Although operating margins on services are comparatively lower (21% in Q3 2017 versus about 29% for its products division), the revenue stream is more stable on account of more recurring revenues. Moreover, as Motorola’s installed base of LMR systems grows, the company will have an opportunity to grow its software as well as managed and support services sales. For instance, the company says that its recurring revenues as a percentage of total revenues have grown from about 10% several years ago to about 25% to 27% currently. Motorola has also been investing in the software space, via internal development and as well as strategic acquisitions. For example, the company is looking to double down on command center software, which is used for emergency call handling. It’s possible that a greater investment in the software space could allow the company to lock in customers over the long-term, while potentially improving margins for the services business.

Source:-Forbes