BlackBerry primarily provides software and solutions that enable endpoints – which include smartphones, computers, sensors, vehicles, and other connected devices – to trust one another, communicate securely, and maintain privacy. The need for such applications is rising, with enterprises becoming more decentralized, with applications moving to the cloud, and the number of endpoints growing. In this analysis, we break down the key drivers of the company’s revenues.

What Are BlackBerry’s Key Business Segments?

1. Enterprise Software (expected to contribute 44% of 2020 revenue): sells software products including the BlackBerry enterprise mobility suite, which provides endpoint management and BlackBerry AtHoc, a secure communications platform.

2. Licensing IP & Other (32% of 2020 revenues): this segment is responsible for the monetization of the Company’s global patent portfolio as well as the mobility licensing operations, which license the BlackBerry brand and device software to handset vendors.

3. Technology Solutions (22% of 2020 revenues) : the business includes BlackBerry QNX embedded software as well as several emerging businesses such as the BlackBerry Radar fleet management solutions.

4. Handset & Related Services: includes the legacy handset of Service access fee business.

What Are The Alternatives?

- In the endpoint management space, BlackBerry competes with the likes of IBM, Microsoft, VMware, and Mobile Iron.

What Is The Basis of Competition?

- Ease of integration with customer’s IT systems, security and reliability, and price.

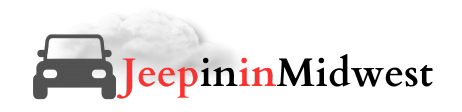

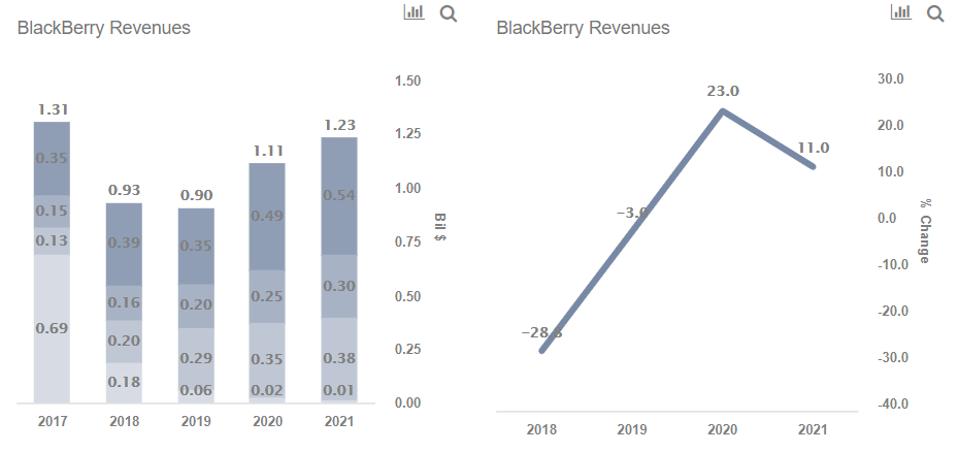

BlackBerry’s Total Revenue has declined from $1.3 billion in FY’17 to $900 million in FY’19 and is expected to recover to around $1.2 billion in FY’21

TREFIS

Revenue growth of about $330 million over the next two years to be driven by Enterprise Software business (+$190 million), with the rest coming from Technology Solutions and Licensing.

- BlackBerry’s revenues have declined by about $400 million over the last 2 years, due to a sharp decline in the handset and related service revenues.

- However, we expect revenues to expand by ~$300 million over the next 2 years, driven by Enterprise software, Licensing, and Technology solutions.

Revenue from Enterprise Software to increase 1.5x (about $190 million) in the next two years, with its share of Total Revenue expected to be about 44% by 2021

- Enterprise software revenues remained almost flat between FY’17 and FY’19, due to higher competition and also due to a change in accounting standards.

- We expect these revenues to grow to $543 million by 2021, driven by BlackBerry’s recent acquisition of cybersecurity company Cylance.

Revenue from Enterprise Software to increase 45% (about $90 million) in the next two years, with its share of Total Revenue expected to be about 24% by 2021

- Technology solutions sales grew from $151 million in FY’17 to $204 million in FY’19, driven by higher sales of QNX to the automotive market and stronger sales of the fleet management solution.

- We expect sales to rise to about $296 million by FY’21.

Revenue from Licensing, IP & Other to increase 34% (about $100 million) in the next two years, with its share of Total Revenue expected to be about 31% by 2021

- Licensing, IP & Other sales grew from $126 million in FY’17 to $286 million in FY’19.

- We expect the metric to grow to about $380 million by FY’21

Revenue from Handsets and Related Services will decline 80% ($45 million) in the next two years, with its total share of Revenues falling to under 1%

- Handset and related services sales have declined from $687 million in FY’17 to just about $59 million in FY’19, as BlackBerry exited the handset space while seeing significant attrition of legacy handset users, who paid a monthly subscription fee.

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs

[“source=forbes”]